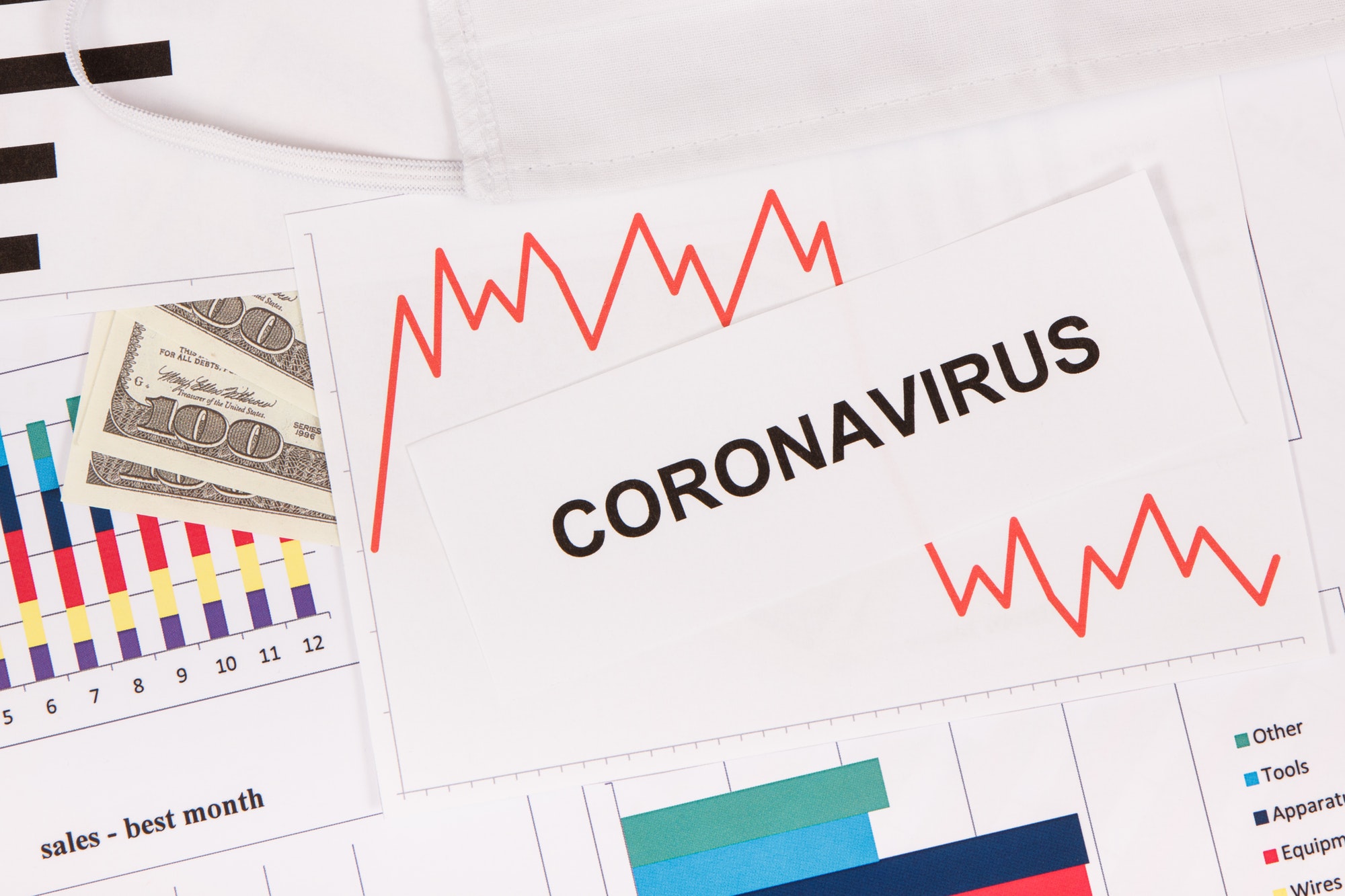

The grave impacts of the COVID-19 pandemic left small businesses reeling. Some have closed their doors for good. If you are a small business owner, you may question yourself. Can small business owners file for unemployment?

The short answer is: Yes, you could file for unemployment. There are caveats though, they need to qualify for certain criteria. On top of this criteria, filing for unemployment depends on what state they are operating in and their employment status in their business.

Wage-earning employee status

The first criteria is if you are an employee in your business. If you are a sole proprietor, then it is possible that you may not qualify.

To qualify under this criteria, you must meet two requirements. The first is if you hold a position like CEO, president, or general manager. If you perform a specified set of roles under your position, then you could qualify for unemployment benefits.

The second requirement is you must be a wage-earning employee in your business. Your paycheck must have state and federal taxes deducted to it as well as other pre-tax benefits.

You pay unemployment taxes

Revisit your tax records, do you pay Federal and Unemployment Taxes (FUTA)? You are required to pay for all of your employee’s federal and state unemployment taxes. States fund their unemployment programs through self-reported company taxes. It funds the program and allows states to calculate the amount for unemployment benefits.

Exemptions to unemployment taxes include: Religious organizations, nonprofits, educational institutions, and government employers.

Loss of employment

This criterion is the easiest to qualify for in claiming unemployment benefits. You are eligible for unemployment benefits if you lost their job through the following reasons:

- you were laid off;

- fired for non-misconduct reasons;

- voluntarily quit for a good reason;

- fired due to a labor dispute; or

- you lost your job due to a force outside your control.

If you shut your business down due to the pandemic, then filing for unemployment benefits under the last reason would be your best bet.

You are actively seeking for employment

If you are actively looking for a job, then you may claim your unemployment benefits. You must be ready, willing, and able to work, though. FIle for weekly claims if you qualify under this criterion. It serves as proof that you are actively seeking work and register at a state unemployment office.

Are you planning to close your business down? Before you do, make sure you read how these entrepreneurs are beating the COVID-19 pandemic here

Opinions expressed by AsianBlurb contributors are their own.

The editorial team for AsianBlurb.