(Trigger Warning: Suicide, Death)

Are you a stock trader and investor? Make sure you read on to understand the risks of participating in the stock market. A 20-year old in Illinois has died in an apparent suicide after his trading account in Robinhood reflected a negative $730,000.

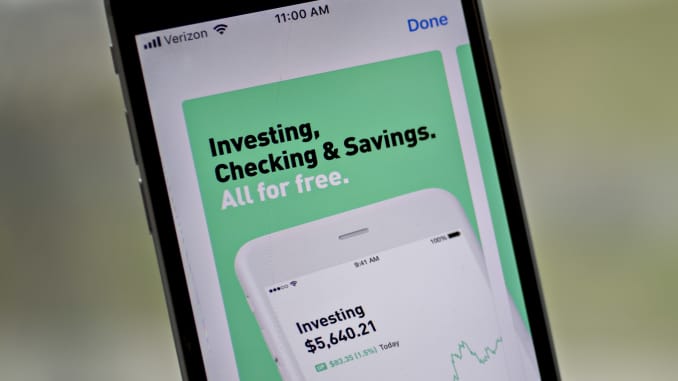

Alexander Kearns, a student from the University of Nebraska, currently living with his parents in Illinois has taken his own life. During the pandemic, Kears took up stock investing with the millennial-centric brokerage firm, Robinhood. To the firm’s credit, they have developed an interesting platform. They have streamlined their mobile application; making it fun and easy to use for beginners. Robinhood also awards its customers with free shares of stock. For the first quarter of the year, the platform has observed a whopping 3 million new accounts.

Examining Kearn’s Final Note

As the pandemic threatened the whole world, Kearns began experimenting with stocks. He began exploring trading options. The final note he left his parents read as follows:

“How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?”

Kearns in his suicide note.

Kearns also expressed his anger at Robinhood saying that he had no idea what he was doing. As Forbes tries to explain, he may not really have been in deep debt. The $730,000 in his account could be his temporary balance “until the stocks underlying his assigned options actually settled in his account.” Forbes tries to explain.

Explaining What Really Happened

Forbes thinks that Kearns was trading what’s known as “bull put spread”. Here is how the method works as per Forbes’ explanation:

“…a bull put spread involves selling put options at a higher strike price, and buying puts at a lower strike price, both with the same expiration. The trade generates a net credit, which the options trader keeps if the stock price stays above the higher strike price through expiration.”

Forbes on what trading strategy Kearns was using in the platform

Bull put spread is considered a limited risk strategy because the maximum loss per share is the difference between the strike prices minus the amount earned when the outs are sold initiating the trade.

According to his cousin, Bill Brewster, he may not have committed an extremely costly mistake. He may have not realized that the negative six figures in his account are temporary. It will be corrected when the stock reflects in his account. Forbes reports that it is common for cash to show negative figures after the first half of the options are processed and before the second options are exercised.

The Risks In The Stock Market

Brewster says that Robinhood tries to gamify trading and makes it seem like they’re investing. A fundamental rule in the stock market is “do not treat it as a game”. Make sure you set aside some time in studying its basics first.

Opinions expressed by AsianBlurb contributors are their own.

The editorial team for AsianBlurb.

Pingback: Robinhood Respond to Teen's Suicide With Massive Platform Changes - Business Blurb

Pingback: These Are The 10 Most Expensive Stocks In The Market - Business Blurb